First Quarter 2020 Market Commentary

First Quarter 2020 Market Commentary

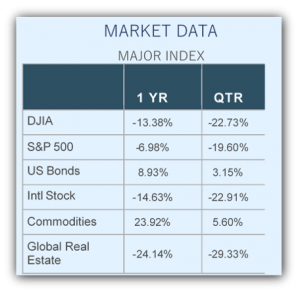

At the beginning of January this year, I could not have predicted that I would be writing about a stock market decline of 20% year-to-date, the worst quarter in 12 years. This has been an exhausting quarter, with stocks moving 10% up or down on individual trading days. In January, most predicted that 2020 would bring a market return in the rage of 3-5%.

At the beginning of January this year, I could not have predicted that I would be writing about a stock market decline of 20% year-to-date, the worst quarter in 12 years. This has been an exhausting quarter, with stocks moving 10% up or down on individual trading days. In January, most predicted that 2020 would bring a market return in the rage of 3-5%.

Last summer, we grew concerned about a Trump/Sanders election and then a Sanders win. We began transitioning portfolios to have lower allocations to small caps, focused on quality mid and large cap stocks and added a technology fund to overweight our portfolios to that sector. The reasoning at the time was that if there is a large market selloff, we would still participate but would do so in companies with good financials to weather the political change. What we didn’t know at the time was that we were really bracing for COVID-19. The recent market declines have certainly tested our new allocations but compared to the overall market and our risk adjusted benchmarks, we are performing as expected.

Brad Lyons, CFP® joined us in December of last year, just in time to learn the TD Ameritrade platform and execute timely trades, including a firm-wide portfolio rebalance and tax loss harvesting in our taxable accounts. We fully expect to test the lows of the market again and will look at any beneficial portfolio moves that could benefit you in the long-term. Sometimes, the best thing is to do nothing.

During the last month, we have been checking retirement plans and how they have been affected by the market fall out. Our financial plans include a scenario where the market drops over 20% and then has an average rate of return going forward. Therefore, we have already planned for an event such as this in your retirement planning. I have yet to find a retirement plan that no longer works. If you are retired, we have cash reserves prepared for this event. If you are working, you are buying more shares per dollar in your 401(k). This is a great opportunity to keep investing.

If you have experienced a job loss, reduction in pay or any other cash flow concern, please do not hesitate to reach out to us. We are here to help you through tough times as well as prosperous ones. We are available on GoToMeeting for review meetings or on-demand meetings.

Quarterly Reports

Each quarter we generate a detailed performance report looking back one year through our Morningstar portfolio accounting software. You can access this report by logging in here.

If you need login assistance, please use the forgot password feature on the Morningstar login page. Should you need help with your username, please contact our client service manager, Tiffany Spino at 678.905.4450 or tiffany@wiserinvestor.com

Casey T Smith

Posted 4/3/2020

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.