How Does Income Affect IRMAA Premiums on Medicare Part B?

Part B Premiums

Medicare Part B acts as general medical insurance for those 65 and older. Medicare Part B requires a standard premium to be paid by all its recipients. In 2022 this premium was $170.10. This premium is determined by the Centers for Medicare & Medicaid Services each year. It is calculated to cover 25% of the of projected average per capita Part B program costs. Many people will only pay the Part B premium, but some people will pay an Income-Related Monthly Adjusted Amount (IRMAA) premium in addition to the standard premium.

What does an IRMAA Premium mean to you?

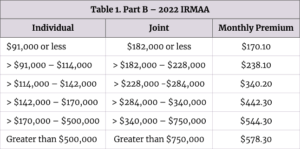

The income used for IRMAA is a form of modified adjusted gross income. It is different from your adjusted gross income because some people have other income sources that need to be added in to determine their IRMMA specific modified gross income. IRMAA is calculated from the income reported on your tax return two years prior. For your 2022 Medicare premium, your 2020 income reported on your tax return is used. If your modified adjusted gross income is above $91,000 individual or $182,000 joint for the year 2020, then for the year 2022 you will be paying an additional monthly premium that aligns with the chart below. The IRMAA amount is recalculated on an annual basis. Previously, for 2019, the income requirements were $85,000 and $170,000. 2020 was the first year they accommodated for inflation, and it will continue to account for inflation.

What can you do to be proactive?

If your monthly premiums are higher because you just retired and your income will now be lower, you can file an IRMAA appeal. Retiring is a qualifying event that allows you to adjust the premium you pay for Part B. The process is simple. You can go online or in person to the Social Security office and complete a request for reconsideration form. Another option is to live on after-tax money, like a Roth IRA or a Roth 401k which will reduce your taxable income. For example, if you have a pension and social security and need additional funds, you do not want to take funds from a traditional IRA. If you were to exceed your IRMAA threshold it would increase your premium amount, instead use after tax money, which has already been taxed previously. Roth IRA and Roth 401ks are the ideal way to do this since the taxes was already realized when the contribution was made, not when the withdrawal occurs. In addition, if you choose to utilize a brokerage account. You will need to be aware of any capital gains within your brokerage account to not realize more income than necessary. These capital gains can be offset by capital losses as well to lower your reported income amount.

Since this is a premium that cannot be typically avoided, the best thing you can do is prepare. The IRMAA Premium is determined on the income of two years prior, so use that number to estimate if you will be at the threshold for the year of having an additional premium. Proper income planning is essential in preparing for and living life to the fullest in your retirement years.

Sources:

https://sgp.fas.org/crs/misc/R40082.pdf

For more information on living within your means during retirement: https://wiserinvestor.com/managing-cash-flow-in-retirement/

For more information on Medicare Part B: https://wiserinvestor.com/changes-to-medicare-part-b-premiums/

Have more questions? Contact Us

Michaela Dowdy

Financial Planning Associate

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.