How Tax Loss Harvesting Works

Over the past few weeks, we have discussed various strategies for reducing taxes through retirement plan contributions and charitable giving strategies. Another tactic we use at Wiser Wealth Management is tax loss harvesting within our asset management. This can be done throughout the year and the process provides value by selling a security or a fund, at a loss and “harvesting” it to offset potential gains. The investor can then repurchase one that is similar, but not substantially identical in order to avoid the “wash sale” rule and maintain preferential tax treatment. Keep in mind, though, the importance of avoiding a violation of the “wash sale” rule. It is an IRS rule preventing investors from taking the aforementioned loss deductions. It applies when someone sells a certain security at a loss and then within 30 days or less, purchases another similar or substantially identical security. Also, the rule applies if a spouse does the same thing during that time period.

If tax harvesting is done properly, however, once the investor offsets the capital gains due to the losses, she can even use up to $3,000 annually against her ordinary income with the extra losses carried over into future years indefinitely. It is important to note that in this strategy we are not getting out of the market or changing our allocations. Rather, we take some losses and then reinvest back into similar funds for at least 30 days.

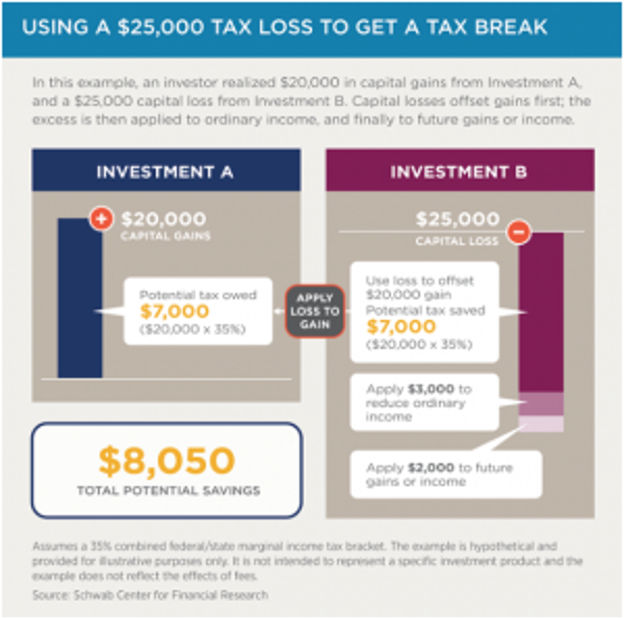

In the example below from Charles Schwab, an investor in the 35% combined federal/state tax bracket might take advantage of a $25,000 loss of a security or fund on an account with a $20,000 capital gain. They could apply $20,000 at their tax rate for $7,000 in potential taxes on the capital gains and then use $3,000 against ordinary income for the potential $8,050 in savings. The remaining money could then be applied to offset future gains.

This process allows you to use the underperformance of certain funds to your advantage to reduce your tax bill while still investing for the long term to reach your financial goals. If you would like to learn more about this technique or how we help clients with tactical asset management and tax efficient financial planning, please feel free to reach out to us on our website, www.wiserinvestor.com or by calling 678-905-4450 ext. 106.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.