How to Stay Wealthy During Retirement

As we continue our series on retirement planning, I wanted to discuss a few tips to stay wealthy during retirement. There are various ways to maintain your wealth even during a lengthy retirement that include making and sticking to a financial plan, continuing to invest long term and not making emotional decisions, and anticipating increases in living expenses due to healthcare costs.

Have a Financial Plan and Stick to It

It is essential to draft a financial plan before retirement so that you have an idea of what your retirement picture looks like. During the planning process, we use Monte Carlo analysis and run 1,000 stock and bond trials to find the highest probability of success for your retirement goals. Our planning process also takes into account several scenarios that can greatly affect your wealth during retirement. It considers the increase in living expenses you will face throughout retirement due to inflation by running projections at 2.25%. It also looks for ways to optimize social security and other tax efficient withdrawal strategies that will best help you maintain your goals. Additionally, we plan for bad timing such as a market down turn over 20% and then another 7% the following year to account for a sequence of return risks. Using these parameters, we can help you formulate and stick to a realistic financial plan that will last your whole retirement.

Invest Long-Term and Don’t Make Emotional Investment Decisions

In early 2020, the stock market hit all-time highs and unemployment was at record lows. Then suddenly, the black swan event of the coronavirus pandemic happened. The market dropped over 30% from intra-year highs, there were talks of a new depression and unemployment claims skyrocketed to new record highs. We received a lot of calls from investors asking whether or not they should go to cash and wait it out. After all, the world was ending, right? These concerned calls were not without basis. The drop in the market happened in an unprecedented and especially short period of time because of an exogenous event, the coronavirus, that we could not have planned for. It was the sharpest decline in the market in history (of over 30%) just above the Great Depression. (source: BofA Global Research). We understand the anxiety investors felt when dealing with such sudden and extreme volatility. However, we did not advise going to cash.

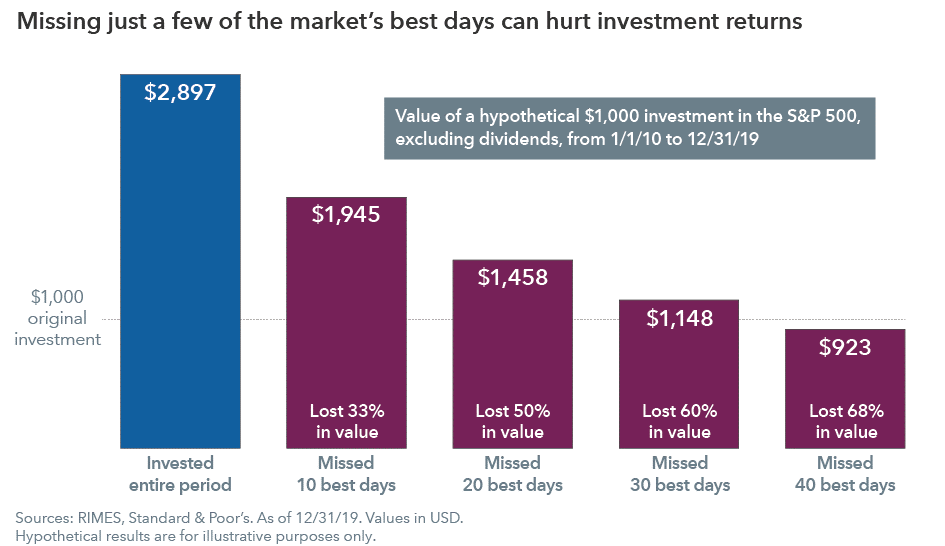

You rarely talk to advisors who advise getting out of the market at these moments in order to “time” the market. Why? Because it is about time in the market and not timing the market. As shown below in a chart from Capital Group, missing out on the best days of the market can have a huge impact on the recovery of your portfolio values. From 1/1/10 to 12/31/19, missing out on the 10 best days, causes this portfolio to miss 33% of possible growth. Missing out on the 20 best days caused a 50% reduction. It is almost impossible to predict when the market will actually bottom out. Getting in and out is a bad idea because in order for it to work, you have to be right twice. This means getting out at the perfect time and getting back in at the perfect time.

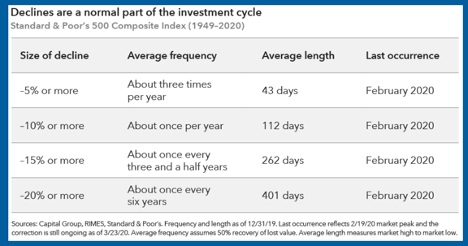

Even in the midst of the coronavirus crisis, markets began to rebound quickly in only a month and since then the market has doubled from its March 23rd lows. It is important to understand that regardless of the event, declines happen frequently. Since 1949, market declines of at least 5% have happened about three times a year, 10% drop yearly, and 20% or more happen about once every 6 years. The average length for the big bear market can range anywhere from months to years.

Investors need to realize and understand that while down turns happen frequently, in the long run the market is up. For example, on a 5-year rolling period, the market is up 88% of the time going back to 1927 and over a 10-year rolling period, it’s up over 94%. When we look at 20-year periods that number is closer to 100%. It is important to not let your emotions get in the way and to plan to stay invested for the long term. Remember that a good financial plan has prepared for the bad times. The real loss happens if you sell.

Plan for Healthcare Costs

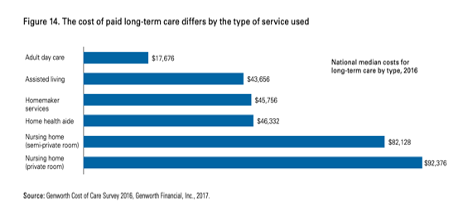

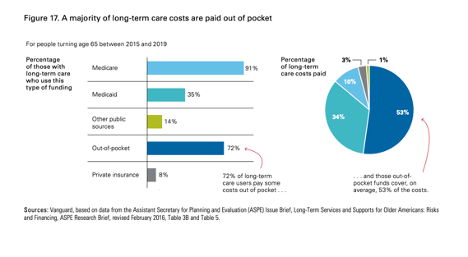

An often-overlooked aspect of retirement planning for clients is healthcare planning. Investors might look ahead and think that Medicare costs will not be too pricey, and they won’t have to worry about coverage in retirement. Unfortunately, healthcare costs are increasing at a higher rate of over 5% per year. It is estimated that a couple will spend over $295,000 in out-of-pocket costs over their retirement and this doesn’t even include long term care costs which are not covered under Medicare at all. The average nursing home costs around $85,000 annually. According to a Vanguard study, about half of retirees can expect to incur no long term care cost, however, 15% can expect to pay over $250,000 in costs. These expensive, long-term stays can derail a retirement if not properly planned for. As shown below, assisted living is still not cheap at over $43,000 and even the more popular choice of home health services range to over $45,000 annually.

Unfortunately, without planning for these events many people are forced to pay out of pocket and risk their retirement future.

Staying Wealthy in Retirement

There are various ways to stay wealthy in retirement, but to do this it is important to focus long term and stick to your financial plan. It is also essential that your financial plans accounts for both good and bad times. And, of course, you need to live within your means to enjoy the highest probability of success throughout your retirement. Stay invested based on your risk tolerance and capacity and do not make rash decisions when the market is down. Also, remember to plan for increased health care costs. Pick the best Medicare plan for your family and look at long term care insurance as an option if needed or if even viable. If you have any questions, please feel free to reach out to us.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.