Inflation Over Time

One of the unfortunate truths about investing is that no matter how much your money grows over time, inflation will always exist to counteract growth. The rate of inflation may fluctuate over time, but it is an important factor to consider when choosing where to invest your money. Because inflation is not a visible loss from your investment portfolio each year, it is crucial to track and acknowledge when measuring the performance of your investments. Let’s look at how inflation has changed over time and how it affects your finances. This blog is a part of a series written by our summer intern, Makenna. This series is based off excerpts from the well-known book, A Random Walk Down Wall Street.

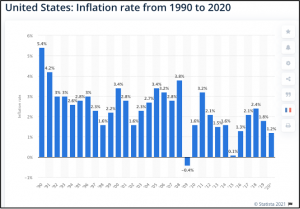

Historical Inflation:

This graph shows the decrease in inflation from 1990 to 2020. Rates of inflation vary widely year-to-year, but the overall trend is decreasing which is good news for the United States economy. Some interesting inflation statistics from the Bureau of Labor Statistics show large price differences over the last 20 years. In 2001, the average cost for one pound of ground beef was $2.05. It now costs $4.29 per pound. The cost of chicken has increased $0.42 per pound, a loaf of bread has increased $0.50, a gallon of gas has increased $1.28 since 2001. The Covid-19 Pandemic will almost certainly affect the rates of inflation over the next few years as well, so you may want to consider inflation in your short-term investment decisions.

Interest and Inflation

The purpose of investing is to increase one’s wealth. If inflation rises at a higher rate than your money is growing, your money is losing purchasing power. Savings accounts at banks, for example, often have interest rates around 0.1%. Even if inflation rises slowly at a rate of 2%, it rises much faster than most savings accounts. Most people do not view savings accounts as strong investments, but this example proves that placing your money where it does not grow at least at the rate of inflation will cause your money to lose purchasing power. Each type of investment has positives and negatives in terms of risk and return, but be aware that some safer investments with small growth rates might not produce enough returns to counteract the rate of inflation.

Does inflation create investment risk?

Furthermore, inflation creates investment risk, as it is generally unpredictable. Predicting the rate of return for a stock is already difficult, and forecasting the value of a dollar in the United States only increases the difficulty. Another consideration for investment risk is inflation across countries. The United States has a conservative rate of inflation compared to other countries, and if you intend to make foreign investments, factor in that country’s rate of inflation when making your investment decision.

Debt Over Time

Additionally, inflation works against you if you have debt. It may not seem like a large difference over a short period of time, but let us explore an example using real estate. If you take out a 30-year mortgage on your house for $200,000 while inflation rises at an estimated rate of 2%, the value of your purchase will be $362,272 by the time you pay it off. This excludes interest for simplicity. Financially, it is wise to repay one’s debts as quickly as possible to lose the least amount of money toward interest payments. Early payments will also decrease the negative effect of inflation.

Looking at past inflation statistics as well as how they affect investment decisions can help investors better understand the fluctuation of the value of a dollar in the United States economy. Learning about inflation can give you the power to work against it with your savings and investments throughout your life.

Makenna Cooper

Summer Intern / Berry College Student

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.