Methods for Long Term Investment Success

There are many new ways to speculate and make money nowadays. Whether that is through cryptocurrencies, meme stock trading, or even speculative stock investing based on IPOs or perceived undervalued companies. However, while it might not always make the news or be the flashiest way of doing things, there are some tried and true methods for long term investment success. These include investing in ETFs, allocating over healthy asset classes, and controlling behaviors and emotions.

Benefits of ETFs

At Wiser Wealth Management, our strategic portfolios are comprised solely of Exchange Traded Funds or ETFs because they have a few distinct advantages over mutual funds or even individual stock picking. First, they are more tax-efficient. They very rarely distribute capital gains in December like mutual funds, which over the last few years could have significantly impacted tax liabilities. Also, they are much more cost-efficient in terms of fees.

Fees for Investment Accounts

Investors frequently overlook or misunderstand how much they pay in fees for their investment accounts. Some firms neglect to discuss fees with their clients upfront, and they continue to gloss over them by not providing readily available information in their statements. According to a survey by Rebalance IRA published in a recent Forbes Article, 46% of a sample size of baby boomers believe that they do not pay any fees at all in their retirement accounts. In addition, another 20% believe their fees are less than 0.5%. However, these are inaccurate assumptions. Most firms have some type of management fee based on their assets under management, or AUM, outside of 401k accounts. Also, the costs usually do not stop there, and additional fees can easily be overlooked.

What are Expense Ratios?

If the advisor is using mutual funds, there are Expense Ratios, or Internal Expenses that get billed outside of the initial management fee. Also, most 401(k) platforms usually have some higher-cost mutual funds within their platforms. So, even if you are not paying an advisor for any management, you are still paying other fees.

For example, many mutual funds have expense ratios of at least .70% meaning for every $1,000 invested $7 is for the expenses. Unlike the management fees, these are not deducted from the account and their return is the net of these fees. These fees are usually institution-type shares, but some commissioned advisors still use A-shares. A-Shares are significantly higher than other mutual funds and can have a 5+% front load meaning that the whole amount is not invested and 5% is initially deducted as the sales charge. They could also be B or even C shares if older and they may include additional 12b-1 fees annually to pay for the fund’s marketing and other promotional costs. Administrative fees and operating costs can also be included to pay for the fund’s managers, research, and certain record keeping.

Don’t Pick a Fund Based on Performance

The latest report from S&P Dow Jones Indices shows that picking a fund purely based on performance is statistically a losing game as very few funds can consistently stay on top. Out of the funds that were top performers as of June 2021, only 4.80% managed to stay on top over three consecutive 24-month periods. Looking longer term, only 3.08% of large-cap, 0% mid-cap, and 2.94% of small-cap funds were able to stay in the top half of their peers over five consecutive years.

Ways to Diversify Your Portfolio

While mutual funds are a great way to diversify your portfolio through a basket of securities rather than selecting individual stocks and bonds, there are no other options offered through index funds or ETFs. Some funds are more cost-efficient than others, but this allows the portfolios to have overall expense ratios of around .06% rather than the .7% found in most mutual fund accounts. ETFs are also more tax efficient and rarely distribute any additional capital gains tax to the consumer at year end like mutual funds.

Diversify ETFs Across Asset Classes

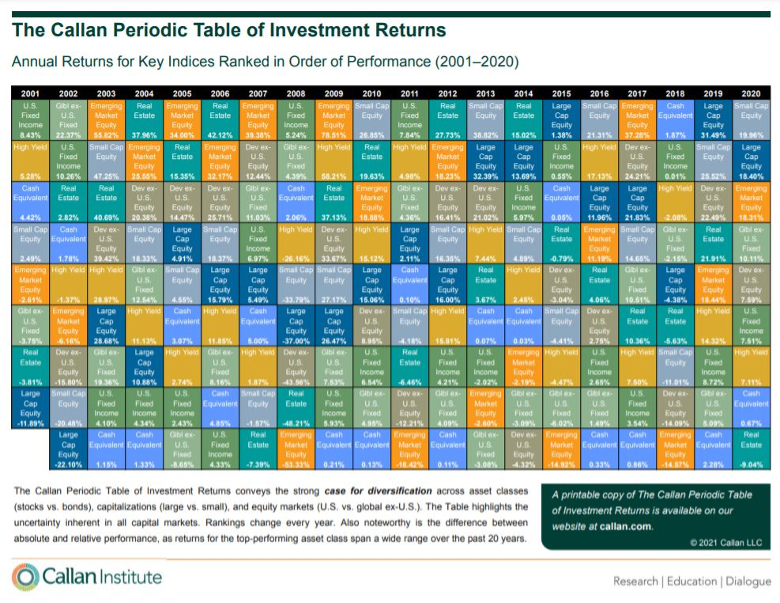

The second way to invest for the long term is to diversify ETFs across asset classes. Rather than looking for various funds or ETF sectors to focus on, look at the overall asset class. Referencing a mix of large-cap, small-cap, internationally developed, emerging markets, real estate, and bonds can be a start. While the last few years have been a great place for large-cap companies given the popularity of tech companies, they are not always the top performers. As seen below, the top-performing asset class one year might not be the best-performing the following year.

Each asset class has not only its own returns but also comes with its own risk or standard deviation as well.

Behavioral Challenges with Investing

One of the most overlooked aspects of investing and one of the only parts you actually have control over is your behavior. There are many behavioral challenges to be aware of when it comes to investing. Money matters are emotional because our livelihoods, families, and dreams can be greatly impacted by our financial decisions. Stress in the market or economy can cause investors to make irrational and/or biased decisions that seem right at the moment but may not be productive in the long run. One of the best ways to stay on top of your own emotional impulses, and have healthy investment behavior, is to gain a larger perspective by better understanding some of the historic realities of the market.

The Media’s Influence on Investing Behavior

The media also plays a highly active role in influencing people’s behavior when it comes to their finances. They sensationalize market performance, particularly when the market is down. Their hyper-urgent tone intends to draw and grow an audience. The average media consumer tends to click more on headlines portraying “economic mayhem” far more than they click on uplifting or encouraging financial stories. Likewise, herd mentality is another factor that plays into an individual’s investment behavior. When a friend or colleague pitches their current action plan, oftentimes the other person will follow in their footsteps as it seems to be the safest thing to do. If it worked for them, it should work for me – right? It is evident that numerous outside and internal factors can affect one’s outlook and determine their investment behavior.

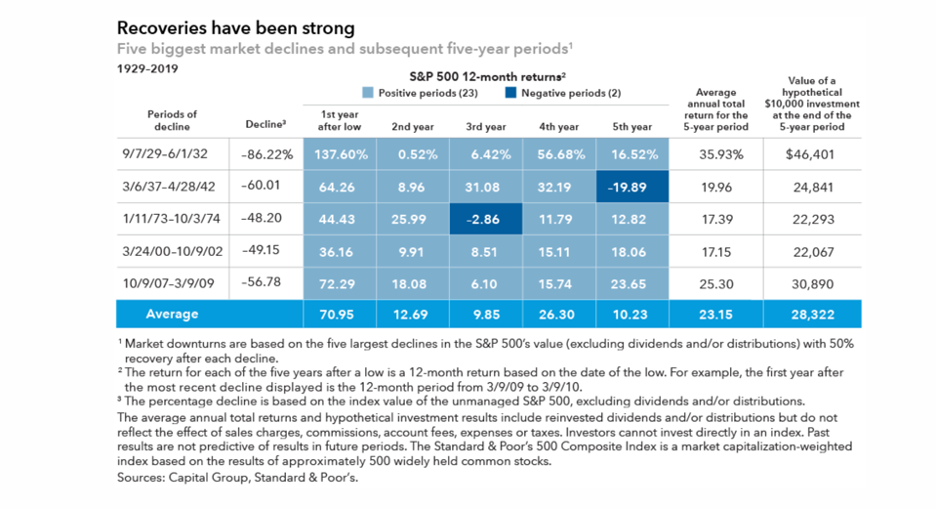

To combat these influences, it is essential to keep in mind a few historical facts about the market. The most important is that in the long run, the market is up. 73% of the time, it is up over a one-year period, 83% over a 3-year period, 87% over a 5-year period, and 94% over a 10-year period. Although there will be drops throughout these time periods, the key is that the market swings back.

Market Ups and Downs are Normal

On average, there will be a 5% drawdown or pullback about 3 times per year, a 10% correction once a year, and even a 20% bear market about every 6 years. Understanding that there will be more up days than down days over the long term is a good way to prevent impulsive decisions driven by loss aversion, even when the timing and length of the down times are unknown.

Missing out on the best days of the market can have a huge impact on the recovery of your portfolio values. From 1/1/10 to 12/31/19, missing out on the 10 best days caused this portfolio to miss 33% of possible growth, and missing out on the 20 best days caused a 50% reduction. Not even the most successful analysts have a crystal ball. No one has the ability to predict the bottom every time. Long term investing is about staying the course and remaining invested during both the good and the bad times.

Methods for Long Term Investment Success

Investing is about controlling emotions and staying in the market. It is about time in the market and not timing the market. Crucial to a sound financial future is a solid investment strategy where you stomach the ups and downs. You should have a portfolio that is invested for your risk tolerance as well as your financial capacity for risk-taking. A too-aggressive investment strategy might be as detrimental as being too conservative with low interest rates and increasing inflation. Understanding how the daily market fits into the overall long-term strategy of your plan is essential for calming the emotions of any given moment. Focusing less on beating benchmarks and more on how you can reach your financial goals and dreams is a much healthier mentality when it comes to investing. Please talk to a financial advisor before making any major changes to your investment plan.

Our team at Wiser Wealth Management focuses on fee-only planning and believes that investments are just one part of a larger plan to help you reach your financial goals and investment success. If you would like a second opinion on your investments or need a financial plan developed, please do not hesitate to reach out.

Have more questions? Contact Us

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.