Is Your Investment Behavior Costing You?

There are many behavioral challenges to be aware of when it comes to investing. Money matters are emotional because our livelihoods, families, and dreams can be greatly impacted by our financial decisions. Stress in the market or economy can cause investors to make irrational and/or biased decisions that seem right in the moment, but may not be productive in the long run. One of the best ways to stay on top of your own emotional impulses, and have healthy investment behavior, is to better understand some of historic realities of the market.

What is Investment Behavior?

A key term when discussing behavior in finance is loss aversion. This phrase describes how a consumer is more motivated by avoiding the bad feelings of potential losses, than they are by the pleasant feelings associated with gains. Loss aversion stems from prospect theory introduced by Nobel Prize winners Daniel Kahneman and Amos Tversky in 1979, who determined that a person feels twice as bad about a dollar that is lost, opposed to the joy felt about a dollar gained. This idea of avoiding losses can certainly lead to difficult decision making when it comes to the market, especially in uncertain times.

The Influence of the Media

The media also plays a highly active role in influencing people’s behavior when it comes to their finances, as they are known to sensationalize market performance, particularly when the market is down. Their hyper-urgent tone is intended to draw and grow an audience. The average media consumer tends to click more on headlines portraying economic mayhem than they do uplifting or encouraging financial stories. Likewise, herd mentality is another factor which plays into an individual’s investment behavior. When a friend or colleague pitches their current action plan, oftentimes the other person will follow in their footsteps as it seems to be the safest thing to do. If it worked for them, it should work for me; right? It is evident that numerous outside and internal factors can affect one’s outlook and determine their investment behavior.

How to Combat these Influences

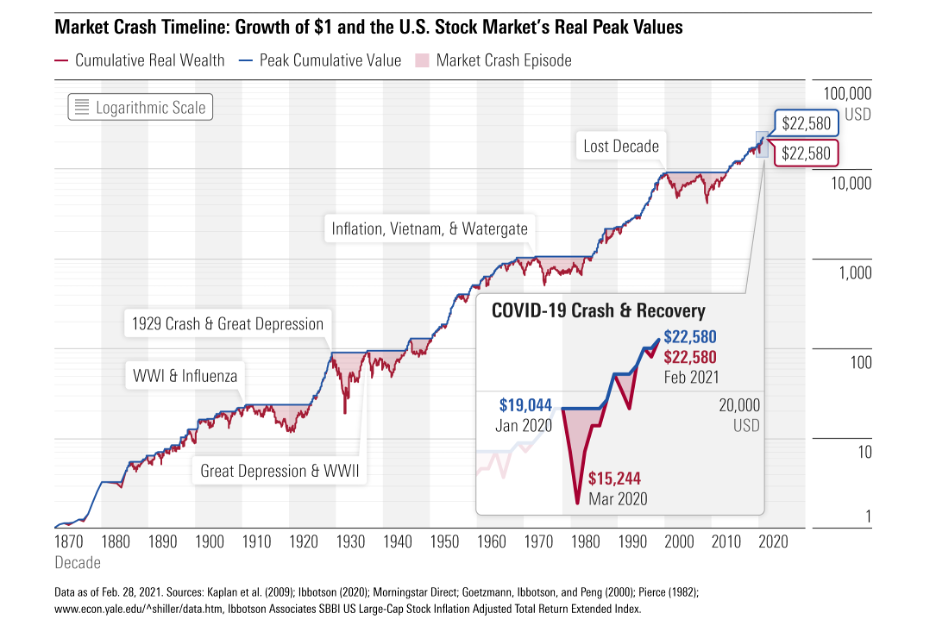

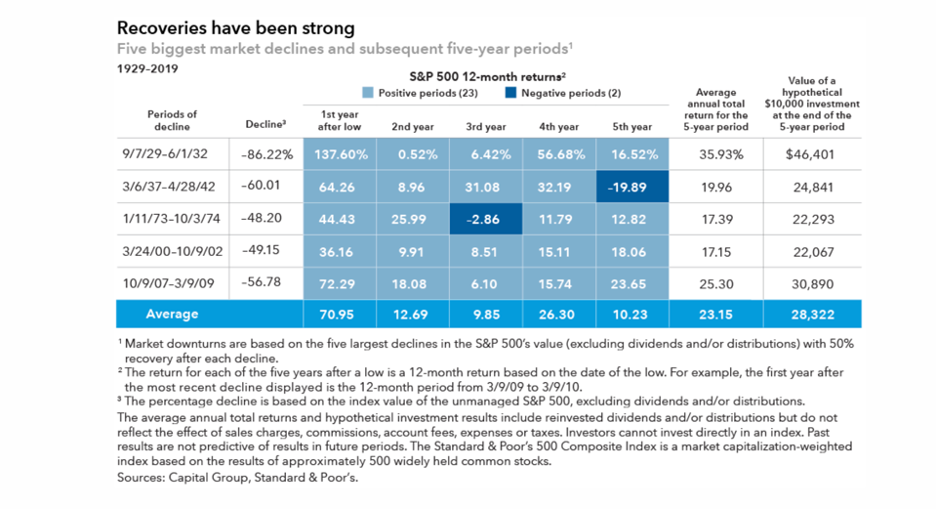

To combat these influences, it is essential to keep in mind a few historic facts about the market. The most important is that in the long run, the market is up. 73% of the time, it is up over a one-year period, 83% over a 3yr period, 87% over a 5yr period, and 94% over a 10yr period. Although there will be drops throughout these time periods, the key is that the market swings back.

On average, there will be a 5% drawdown or pullback about 3 times per year, a 10% correction once a year, and even a 20% bear market about every 6 years. Understanding that there will be more up days than down days over the long term is a good way to prevent impulsive decisions driven by loss aversion, even when the timing and length of the down times is unknown.

Sometimes, like in 2020, these swings can only take few months, but they can sometimes take years. Despite the potential for down times in the market, a good rule of thumb to keep in mind is that it’s time in the market not timing the market that really counts.

As shown below in a chart from Capital Group, missing out on the best days of the market can have a huge impact on the recovery of your portfolio values. From 1/1/10 to 12/31/19, missing out on the 10 best days, causes this portfolio to miss 33% of possible growth and missing out on the 20 best days caused a 50% reduction. Not even the most successful analysts have a crystal ball. No one has the ability to predict the bottom every time. Long-term investing is about staying the course and remaining invested during both the good and the bad times.

The Market in 2022

I realize that 2022 may be a vastly different moment for some investors compared to 2008. Perhaps, they are now retired or nearing retirement and relying more heavily on their investments for everyday living. However, the most famous and dangerous words in the wealth management industry are “this time it’s different.” In fact, it rarely is. There will be differences in the particulars that cause the recessions and other bear market selloffs, but the pattern of the market’s reaction often remains remarkably the same.

Long-Term Investments

With these historic facts in mind, know that if you move to cash, you could – and most likely will – realize significant losses for the year and it will be tough to recover moving forward. Although you are older from when the last great recession occurred, you still have a long-term horizon on your investments. And those investments need to continue to grow and outpace inflation. If you try to time the market and get out now thinking you’ll get back in when the market recovers, you will most likely miss out on the best days of the market because those moves would require perfectly timing the market twice. Getting out at the perfect time before it drops further, and also getting back in at the perfect time once it bottoms out is the only way to make this kind of investment strategy cost effective. And perfect timing is extremely difficult to achieve.

Control Emotions and Stay in the Market

Investing is about controlling emotions and staying in the market. Crucial to a sound financial future is a solid investment strategy where you stomach the ups and downs. Understanding how the daily market fits into the overall long-term strategy of your plan is essential for calming the emotions of any given moment. That being said, this could be a good time to review your risk tolerance and capacity for risk. If you are struggling to sleep at night because of market volatility, then you might consider switching to a more conservative, balanced portfolio after this recovery. Either way, please talk to a financial advisor before making any major changes to your investment plan. Our team at Wiser Wealth Management focuses on fee-only planning and believe that investments are one part of a larger plan to helping you reach your financial goals. If you would like a second opinion on your investments or need a financial plan developed, please do not hesitate to reach out.

Have more questions? Contact us

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.