Q2 2021 GDP

Gross Domestic Product (GDP) is a broad measure of overall domestic production. It functions as a comprehensive scorecard of a given country’s economic health. Over Q1 2021, the US GDP grew 6.3%. During Q2 2021, it has grown by 6.5%. Is this good? If the economy were to grow at a 6.5% annual rate in any other year, everyone would be ecstatic. However, given the COVID disaster and rebound, as well as the federal government’s massive fiscal stimulus and very loose monetary policy, the announcement that real Q2 2021 GDP grew at a 6.5% rate is a bit of a disappointment. The market was looking for an expectation closer to 8%.

The economy is bigger than ever, but it is still not as big as it would have been in the absence of COVID. Notably, nominal GDP (which includes real GDP plus inflation) is right about where it would be if COVID shutdowns had never happened.

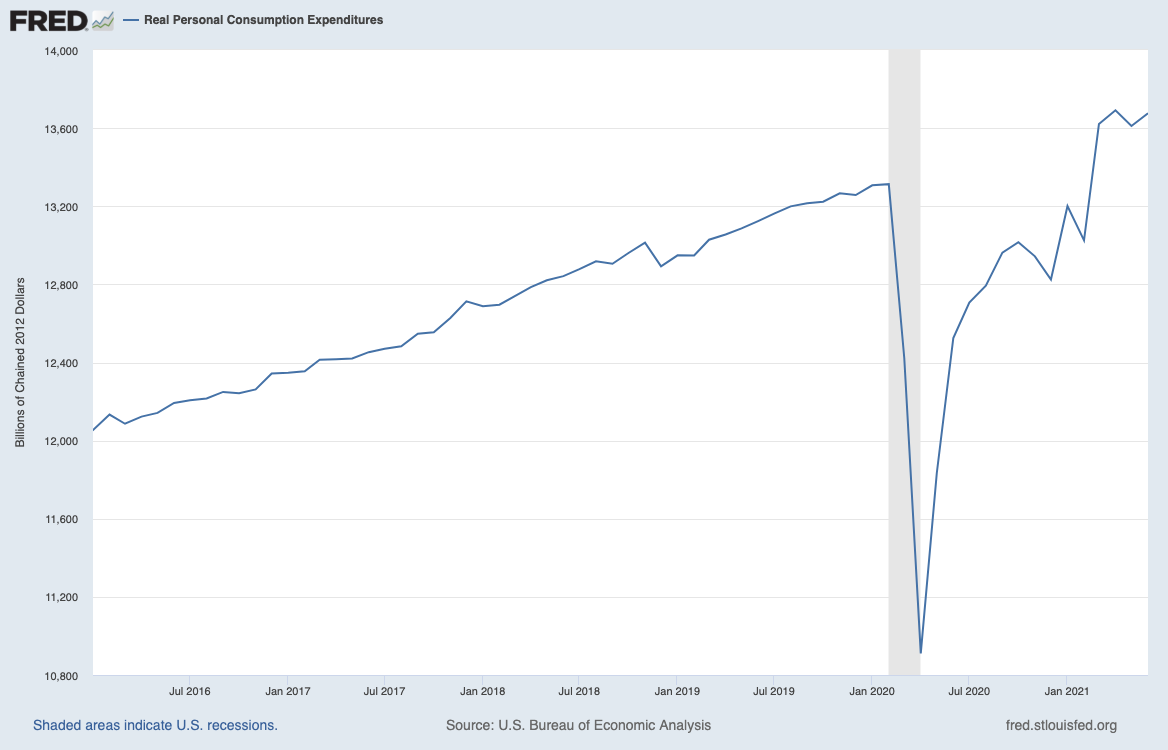

Consumer spending, which accounts for almost two thirds of our GDP, grew at an 11.8% annual rate in Q2 2021 and has approached pre-pandemic trends. Economic growth in Q2 2021 was fueled in part by the huge stimulus package passed in March in which Congress approved sending checks to most Americans and from built-up savings accumulated during the pandemic. After being locked down over the past year, consumers unleashed a torrent of spending on expenditures for travel and leisure activities, household items and clothing. Vaccinations spread throughout the country increasing people’s confidence to venture out and spend money while further accelerating economic and business activity.

In a June survey of commercial-banking clients, JPMorgan found business confidence is at its highest level in the survey’s 11-year history. 46% of respondents said they expect to increase capital spending in the months to come. This gives credence to many economists’ forecast for continued economic expansion in the third and fourth quarters this year, albeit at a slower pace than the first half of the year. Earnings announcements for the second quarter also illustrate that businesses have adapted to new distribution methods for meeting their customers’ demands. Demand was so high in the quarter that many companies couldn’t increase production fast enough and had to dip into inventories to fill their customers’ orders. All-in-all, businesses profited greatly in this quarter. These strong earnings reports, crossing all industries, indicate businesses are returning to profitability. The five largest tech companies – Apple, Microsoft, Amazon, Alphabet (Google) and Facebook – had a phenomenal Q2 2021 earning $86 billion on revenues of $332 billion.

Although the economy is expected to continue growing, the expansion is not without risks. Supply chain bottlenecks persist. For example, Semi-conductor chip production is unable to meet demands and the limited supply of chips has forced some car manufacturers to halt production of certain vehicles. Labor shortages exist and are likely to continue to take some time to be resolved. Although 1.7 million jobs were created in the past quarter, there are still 9.5 million people who remain unemployed. And there may be over 9 million jobs in the U.S. that remain unfilled, however, companies are having a difficult time enticing people to take them. Federal unemployment subsidies have ended in half the states and are scheduled to end in early September for those unemployed in the remaining states. Inflation is another concern. The Federal Reserve has flooded the economy with money to jump start economic growth at the same time that a shortage of goods exists. When there’s more money in people’s pockets than there are goods available, the price of those goods goes up, causing inflation. The effect of this economic phenomenon is being described by Fed Chairman Jay Powell as “transient” and he believes that when the supply chain is reassembled and flowing freely again, inflation is expected to subside.

However, COVID’s Delta variant is the wild card. Right now, the variant is primarily a health concern but should it become more widespread, it could hurt the economic recovery. Government intervention of business activity could cause consumers to get scared and pull back from re-emerging and spending, and businesses would suffer. It is interesting to recognize that each successive wave or spike in cases has resulted in a less severe economic reaction than the previous one. Businesses and consumers seem to learn from each previous experience with the virus and adapt to these changing situations by finding new ways to connect with each other. Companies have digitized their services and distribution networks. They have moved online much of what we previously did in person such as shopping, working and socializing with friends and family. As such, they’ve allowed the economy to continue to grow and prosper.

Future growth in the economy is expected to come from companies replenishing inventories, continued consumer spending and, as previously mentioned, from companies increasing their capital spending. The Federal Reserve Board members stated recently in their July meeting that they expect a 7% annualized growth by year end. Most private economists have a slightly more modest expectation. The reason we’re seeing variations in expectations is because shutting down the world’s largest and most complex economy and then reopening it again has made it very difficult for economists to make forecasts in the same way they had in the past. There’s no textbook on this situation available for people to refer to and read about. There’s no previous example or precedent to serve as a model for our current economic period.

Brad Lyons, CFP®

Investment Manager

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.