Why Stocks Go Down When Oil Drops

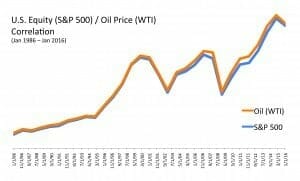

Equity markets descended in January alongside oil prices, while testing new lows with a visible increase in volatility. Oil’s dramatic price drop has been a catalyst for stock prices heading lower, a so-called correlation that has actually existed for years.

There are various theories as to how oil and stock prices might be correlated; yet one of the most accepted revolves around macro economic global dynamics.

Oil is the most traded and actively utilized commodity in the world whose consumption represents the economic activity worldwide. So when oil supplies grow and demand drops, markets interpret that as an economic slowdown. Such a slowdown thus migrates into the equity markets, where economic activity and growth is essential for expansion and higher equity prices.

Lower oil prices can also be beneficial for certain sectors, such as transportation and airlines, whose primary expenses are fuel. Economists expect a possible lag effect with recent low oil prices, which may eventually appear on corporate income statements. Obviously, lower oil prices are not conducive to oil industry sector companies, whose margins shrink as oil prices drop.

Some fixed income investors now view U.S. energy stocks as opportunities to earn higher yields on dividends compared to where they were months ago. Lower valuations on energy stocks have led to higher stock dividend yields as prices have fallen.

Sources: Economic Premise #150 World Bank, IMF Research Bulletin, Federal Reserve System Perspective

Have more questions? Email us at info@wiserinvestor.com or use the Contact Us page.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.