Taking Control of Finances for Your Aging Parents

Are you ready to step in and take control of your aging parents’ finances, and in the process, safeguard them from the lurking financial scams? On this episode of A Wiser Retirement™ Podcast, Casey Smith and Missie Beach, CFP®, CDFA® talk about taking control of finances for your aging parents. They also bring up the importance of being proactive about the potential threats your elderly loved ones may be susceptible to.

Listen on Apple Podcasts or watch on YouTube:

SUMMARY:

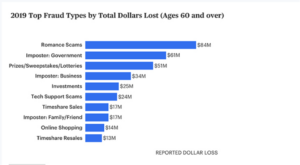

Senior citizens are often an easy target for scammers for a variety of reasons. They might be lonely because their spouse has passed away and their kids live far from home. In some cases, their minds are not as sharp as they used to be. Sometimes they are more prone to trusting in general goodwill, which is not so common anymore. Some of the most common scams that target senior citizens are, romance scams, fake government requests through letters/calls, prizes and sweepstakes, investments, and timeshare sales, among others.

Ways to Protect Aging Parents from Financial Scams:

Communicate

Communication is key when it comes to helping your aging parents be aware of their financial situation and avoid falling prey to scams. So, start the conversation early. Don’t wait until your parents are in a crisis or no longer able to manage their own finances to start talking about it. Let them know sooner than later that you’re interested in helping them, and that you want to understand their wishes for the future.

Take Inventory

Once the conversation has been started, take inventory of your parent’s finances. This includes getting a list of all their assets and liabilities, as well as their monthly income and expenses. You can also ask them to provide you with copies of important financial documents, such as bank statements, investment statements, and insurance policies.

Simplify Bills

Another step that’s very important but can be time-consuming is to simplify bills and take over financial tasks. Once you have a good understanding of your parent’s finances, you can start to simplify things by setting up automatic bill payments and consolidating accounts. You may also want to take over some of their financial tasks, such as writing checks or paying bills online. This could take some time, but once automatic payments have been set up, you and your parents won’t have to worry about the electricity being cut off because they forgot to pay the bill.

Get a Power of Attorney

In addition, consider a getting a power of attorney. A power of attorney is a legal document that can give you the authority to make financial decisions on your parent’s behalf. This can be helpful if they become incapacitated or unable to manage their finances on their own.

Communicate Frequently

Make an effort to turn this conversation into something pleasant that you can do regularly. It’s important to keep your parents updated on their finances and to get their input on any major decisions. This will help to build trust and ensure that you’re all on the same page.

Finally, it’s important to remember that your parents may be resistant to giving up control of their finances. Be respectful of their feelings and be patient as you work together to make a plan.

Download our eBook: “Buyer Beware: Why do they keep trying to sell you that annuity?”

TIMESTAMPS:

0:00 Intro

14:15 Communicate

14:30 Take Inventory

15:10 Simplify Bills

17:30 Get a Power of Attorney

18:38 Communicate Frequently

LINKS:

Learn more about Casey Smith and Missie Beach, CFP®, CDFA®

CONNECT:

Twitter, Instagram, Facebook, LinkedIn, and YouTube.

Learn more about A Wiser Retirement™ podcast and access previous episodes.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.