Tesla joins the S&P 500 (finally)

Tesla is now the sixth most valuable company in the S&P 500, just ahead of Warren Buffett’s Berkshire Hathaway. Going forward, Elon Musk’s company will make up about 1% of the index, slightly less than the 1.3% weight that Berkshire Hathaway had when it was added in 2010.

Tesla’s addition to the S&P 500 on December 21, 2020 has long been anticipated as investors eagerly bought up shares hoping its inclusion in the index and the resultant institutional buying would bid the price up even higher. It begs the question though… Will its investment return have a meaningful impact on the S&P 500 now that it’s been included in the index?

We don’t know for certain. There are some concerns that the index is now too focused on the tech sector. Nearly a quarter of the S&P 500’s market cap weighting is tied up in Apple, Microsoft, Amazon, Google owner Alphabet, Facebook and now Tesla.

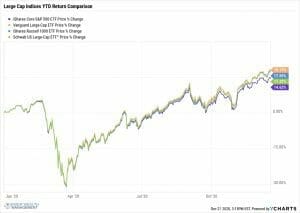

There are however, a number of large cap indexes that have included Tesla for over a year and we can see the return differential between them and the S&P 500 for comparison sake. Three well known large cap indexes and popular investments that track them are:

By comparing the returns of index tracking ETFs that included Tesla as an index constituent to the S&P 500 prior to including Tesla over similar time periods, we can see Tesla’s nearly 700% gain year-to-date had a noticeable impact on the returns.

No other constituent included in VV, IWB and SCHX that was missing in SPY had an index weight nearly as large as Tesla’s. And given the different weights Tesla occupied in the three different indexes, corresponded to three different returns (the higher the weighting the higher the return), we could surmise that Tesla has had a meaningful impact.

Why then did the S&P 500 index sponsor wait so long to include Tesla? The answer is the S&P 500 has a profitability criteria that companies must meet prior to inclusion. To be included, a company’s most recent quarterly earnings and the sum of its most recent four quarters of earnings must be positive. Tesla hadn’t met the criteria until its Q3 2020 earnings were announced.

Brad Lyons, CFP®

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.