Traditional 401k or Roth 401k?

Since the reduction in the number of pensions across America, the popularity of the 401k has increased and become paramount to employee’s retirement success. Retirees used to live off of their pensions, social security and any additional savings they had accumulated. However, most companies have gone away from pensions and transferred the planning to the employee. The 401k was created after Congress signed the Revenue Act of 1978 where there was a provision in the Internal Revenue Code-Section 401k – which deferred taxation of employee’s compensation. Then entered the Roth 401k that was created in 2006 from the Economic Growth Tax Relief Reconciliation Act of 2001. It was modeled after the Roth IRA that was created back in 1997. The ability to contribute to a Roth 401k was supposed to sunset in 2010, but the Pension Protection Act of 2006 allowed it to remain intact. While it is nice having different retirement planning options, it is also very complex and there are many moving parts. A common question investors ask is whether they should contribute to their traditional 401k, Roth 401k or both?

In order to make an informed decision about which account is most appropriate for you, an individual must first know certain characteristics of each account. The main differentiator is whether you need or want the tax benefits now or later in retirement. A traditional 401k contribution is made with pre-tax dollars and you then pay ordinary income taxes on the withdrawal in retirement. However, because this is a deduction from your paycheck it can allow you to reduce your taxable income for the current year. An important concept to realize is that employee matching contributions are made pre-tax. Another important aspect to realize is that because the contributions are pre-tax and grow tax deferred, the IRS would like their money back at some point. Therefore, they created what is called the Required Minimum Distribution or “RMD.” The RMD amount is determined by the account’s balance the previous year times a percentage that is calculated from life expectancy tables. The percentage for a 72-year-old comes out to just under 4% for 2020. Previous to 2020, the RMD age was 70 ½. However, due to the recently passed SECURE ACT (Setting Every Community Up for Retirement Enhancement) signed in December of 2019, the age was pushed back to age 72 as long as you turned 70 1/2 after January 1, 2020. Also with the new law came the 10-year distribution rule, stating that non-spousal beneficiaries may no longer stretch their inherited IRA as an RMD based on their life tables, but rather the whole amount must be distributed within 10 years of the IRA owner’s passing.

The Roth 401k on the other hand is contributed with after tax dollars and earnings are tax free as long as the account has been held for more than 5 years and the investor has reached age 59 ½. The Roth 401k is also subject to RMDs (although not taxed) but that can be avoided if rolled over into a Roth IRA in retirement.

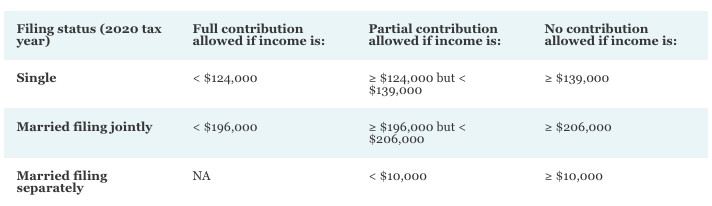

Roth IRAs are individual retirement accounts opened outside of your employer plans. They are contributed with after tax dollars as well, but they differ slightly from Roth 401k in that their contribution limits are lower at $6,000 ($7,000 if age 50 or older) and they do not require RMDs. The entire amount of the account can be passed down to beneficiaries tax free as well. However, as shown in the graph below, if you are single and make over $139,000 (or if married over $206,000) then Roth IRA contributions are not allowed.

(Source: Charles Schwab, from Internal Revenue Service) https://www.schwab.com/resource-center/insights/content/roth-vs-traditional-iras-which-is-right-for-your-retirement

There is a way to sidestep the income limits with Roth IRAs and that is through what’s called the “Back Door Roth.” This is where a client could contribute to a Traditional IRA and then rollover the funds into the Roth IRA account where the rollover amount would then be included as taxable income.

So, at this point you might be wondering why would you choose the traditional 401k or the Roth 401k over the other? The decision boils down to an employee’s current income status as well as where you believe the tax code will be in retirement. The current highest tax bracket is 37%, but in 1981 it was 70% and back in 1963 it was even as high as 91%. While I hope we don’t move that drastically, the fact of the matter is we are in historically low brackets and with our deficit, especially after COVID, taxation policies will most likely increase in the future.

As stated, the goal of the traditional 401k is to reduce income taxes and participate in tax deferred growth. Employees should consider this if by not including that income helps you stay below a certain bracket, or if you believe your individual taxes will be significantly lower in retirement. The key for traditional 401k contributions is that the tax savings received from contributing to the account over a Roth 401k should be invested into a taxable brokerage account each year. An investor needs to be careful having only a traditional account in retirement, as any excessive withdrawals could cause them to move up a tax bracket thus increasing federal social security taxation, as well as Medicare Part B premiums.

If you prefer the Roth 401k, you are most likely a younger investor or also in one of the lower tax brackets and you prefer to pay the taxes now during your working years because you believe you will be in a higher bracket in retirement. Also, if you do not require the income in retirement or would like the remaining balance after your death to be passed to your heir, this will be tax free.

If you are unsure of tax brackets and what the tax code may look like, you can also contribute to both traditional 401k and Roth 401k accounts. The maximum allowed combined between the two is $19,500 and if you are over 50, you can catch-up with contributions each year at an additional $6,500. Having both tax free and taxable income in retirement allows you to manage your tax bracket and allows for effective retirement income planning.

Financial Planning is an ongoing process and decisions should be planned for in advance. At Wiser Wealth Management, deciding which retirement account to contribute to or how much to contribute is one of the many parts of the financial planning process intended to increase probability of success in retirement. If you would like help on this decision and how it fits into your financial plan, please visit wiserinvestor.com to schedule an appointment or by calling 678-905-4450.

Matthews Barnett, CFP®, ChFC®, CLU®, Financial Planning Specialist

**Disclaimer: These are not recommendations and Wiser Wealth Management is not an accounting or legal firm and its affiliates do not provide tax, legal or accounting services or advice. Client’s should consult with their professional advisors before making any decisions.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.