Twitter & Availability Bias

In the current age of social media, individuals have constant access to what’s going on in the world around them with both good and bad results. As most people are aware, social media has an expansive reach and can be extremely influential. Twitter and availability bias give us another example of why acting on a stock tip is not the best approach to long-term investing.

One famous twitterer is the richest man in the world: Elon Musk. He’s gotten into some hot water in recent years for tweeting about his company and its share price. But on January 7, 2020, he made headlines on a somewhat lighter note after he tweeted the following:

His tweet was taken out of context and, unfortunately, influenced millions of people. He was referring to a private encrypted messaging service company called Signal App and encouraging his followers to use the app over WhatsApp after WhatsApp announced they would begin sharing customer data with their parent company, Facebook.

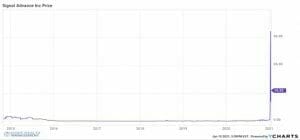

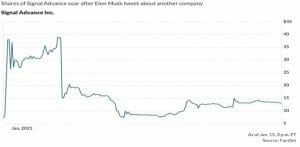

However, many in the investment community thought he was referring to the public company Signal Advance Inc. (SIGL) and over the next three days the company’s stock increased over 5,600%. It went from 60 cents a share on close Wednesday, January 6th to over $30 a share after the tweets. The market cap had also skyrocketed to over $3.1 billion from the previous $55 million cap that Wednesday.

The app company he was originally referring to, Signal, then went on to tweet:

“Is this what stock analysts mean when they say that the market is giving mixed Signals? It’s understandable that people want to invest in Signal’s record growth, but this isn’t us. We are an independent 501c3 and our only investment is in your privacy.”

Confusion over company tickers is becoming all too common an event in the investment community. The situation is somewhat similar to the one back in March when investors had just started working from home and Zoom became a household name. At the time, many investors confused the video software company Zoom Technologies (ZOOM) with Zoom Video (ZM). The mix up caused the SEC to step in and halt trading of the two companies for a day.

The environment around investors today echoes the one in the late 90s when investors were willing to throw money down before they even knew exactly what they were buying. Before the days of the internet, investors used to get their “hot” stock tips from a wirehouse stockbroker. Then, it was from financial newspapers, magazines and TV pundits. Now, investors have 24/7 access to the noise of markets through websites, tweets and other media outlets. This is especially true when those tips come from notable figures like Elon Musk.

When investing, it is important to block out the noise and learn to do your due diligence and not speculate on hearsay, neighbors’ suggestions, or even projections made by billionaires. It is easy to get sidetracked wanting to get rich through buying into the new Tesla or even a new digital currency like Bitcoin. However, it is important to learn not just about the company itself but the industry in general. This way you can decide if the company’s balance sheet and fundamentals make for a wise investment.

While it can be exciting to buy the newest stock or follow the latest hot tip, most often this is a losing game in the long run and not a sound investment strategy. At Wiser, we do not try to time the market or invest in the next trendy company. Instead of chasing individual stocks returns, we invest in diversified portfolios of low-cost ETFs balanced across healthy long-term asset classes. As an investor, it is most important to first determine your risk tolerance then assess how the portfolio allocation fits into your overall financial plan.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.