Wall Street Sell Off

As the market is trying to analyze the economic impact of the coronavirus, it now has to also analyze what cheap oil means for the oil industry and the overall economy. Recent events between Russia and Saudi Arabia have caused oil price to drop below $30 a barrel overnight. This will bring added volatility to the markets. In addition to oil and the coronavirus, bond prices have surged to the highest prices ever, which can also bring new risks on monetary policy by the Federal Reserve. But, you are going to be ok!

We build our portfolios to include events like the ones we are currently going through. You have a plan. This is why you must stay focused long-term. This plan does NOT involve chasing performance, market-timing or reacting to market “noise.” Such temptations multiply during downturns, as investors looking to protect their portfolios seek quick fixes.

Downturns in the market are normal. Between 1980 and 2019, for example, there were eight bear markets (declines of 20% or more, lasting at least 2 months) and 13 corrections (declines of at least 10%). Unless you sell, the number of shares you own won’t fall during a downturn. In fact, the number will grow if you reinvest your funds’ income and capital gains distributions. And any market recovery should revive your portfolio too.

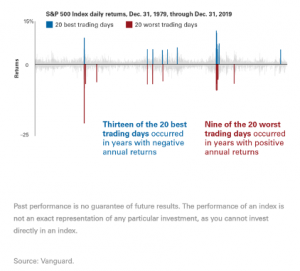

In times of falling asset prices, some investors overreact by selling riskier assets and moving to government securities or cash equivalents. Or they may embrace the familiar, perhaps moving from international to domestic markets, in a display of “home bias.” It is a mistake to sell assets amid market volatility in the belief that you will know when to move your money back to those assets. This is called market-timing and the chart below shows one reason why it is a bad idea.

I guided Wiser Wealth and our clients through the 2008 financial crisis. I learned many things in that year. Two that stand out today are sell some bonds and buy stock when everyone acts like the world is ending. The reward will be amazing. The second is sometimes you just need to turn the news off and go do something else. You should never let a person on television dictate your happiness.

Posted 3/12/2020

By: Casey Smith

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.