What is Fixed Income Investing?

There are numerous ways you can invest your portfolio. It can be a little overwhelming to figure out what types of investments make the most sense for your financial goals, especially in volatile economic moments. A common breakdown is to invest in individual stocks, mutual funds, or Exchange Traded Funds (ETFs) for your equitable exposure and then individual bonds, bond mutual funds, or bond ETFs for your fixed income exposure. So why the difference? And what makes fixed income investing worth it?

While stocks are equities that let you purchase a percentage of ownership in a company, bonds are debts bought by the investor from the issuer. The bond pays investors a fixed interest payment until maturity date. Then, at the point of maturity, investors are paid the principal back.

Different Types of Bonds

There are various types of bonds including municipal bonds, government bonds like treasury bonds and bills, as well as corporate bonds. Treasury Bills have a maturity of less than a year. Other bond notes mature between 2-10 years and investors are paid semi-annual payments. There are also Treasury bonds which mature in 20-30 years. Municipal bonds are issued by the federal government but are backed by municipal, state, or county governments instead. These are raised to provide capital for projects like roads, schools, hospitals, and other civic projects. They are usually federal-tax exempt and can also be state-tax exempt as well.

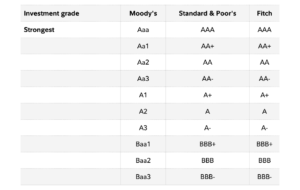

Corporate bonds are usually riskier than other bond types because their value is based on a specific company’s performance and stability. They are rated by companies like Standard and Poor’s (S&P) or Moody’s.

The chart above shows what are called investment grade bonds. They designate quality companies with a history of steady performance. Also within the market, however, are “Junk” bonds or high-yield bonds that can pay a higher yield, but are riskier due to the possible defaults and credit risks of the company they are issued from.

Are bonds safer investments than equities?

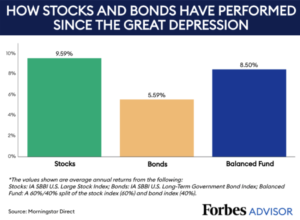

While bonds are usually safer investments than equities, there are still some concerns to think through. The safer aspect of bonds is the fact that they often make yearly moves or changes which can be less volatile than the daily moves of the stock market. They are also said to be good diversifiers as they move down when equities are performing well and up when the stock market is depressed thus offering ballast to a portfolio.

Risk Level of Bonds

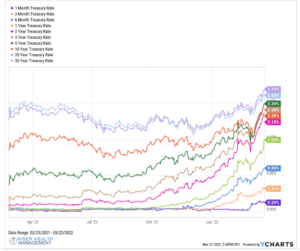

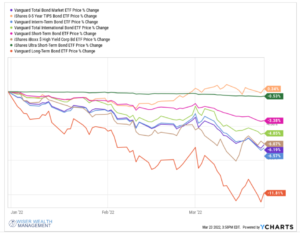

However, bonds are not totally risk free. There is the risk of rising interest rates and this is what we are currently seeing with the bond market today. Bonds have an inverse relationship with interest rates. As rates rise the bond price falls. This can affect longer term bonds more significantly than short term bonds. Bonds are also affected by inflation. Because of the lower returns due to rising interest rates, they may not provide enough of a return to account for inflation causing investors to lose out on purchasing power.

As the chart above reflects, interest rates have been at historic lows for the last 30 years. Rates increased significantly in the 1970s and early 80s before climbing back down in the 90s. Even before COVID in 2018, interest rates were in the process of rising again. Now with the recent announcement by the fed that they are starting to raise interest rates, bond returns are starting to move in response.

Why should we continue to use bonds?

Given the current headlines and economic valuations, investors could be tempted to stay away from bonds. So why continue to use them? The answer is diversification and client behavior. Portfolio diversification with a long-term focus calls for holding onto, at least in small part, all the core asset classes including bonds. Holding bonds today helps to give your portfolio a solid foundation for the next unanticipated crisis and participate in the yield they will provide once rates level out.

When the stock market is climbing investors tend to move to more and more stocks, causing them to buy near the top and sell their bonds at the bottom. Then when the market falls, they want to get out of stocks because it feels too risky to see their portfolio lose money. In this instance, they often sell the stock low and buy the bonds high. If left to repeat this cycle over and over always in response to current market trends, the overall portfolio performance suffers. Granted, that cycle seems logical – if the house is on fire, you get out, right? But this is not always the case when it comes to investing. In portfolio management, successful investment strategies that use long term approaches and eschew gut-based decision making yield better results. Long-term strategies, such as those at Vanguard, are not exotic nor do they provide for great water cooler talk, but the results speak for themselves.

Fixed Income Investing

Investing in bonds for portfolio diversity provides a safety measure for the principal investment, and can even provide some income. While bonds may not provide huge returns, they can act as insurance to see your portfolio through both the best and worst economic trends. If you have any questions about the strategic moves we make at Wiser Wealth Management, or to learn more about how you can incorporate fixed income investing in your portfolio, please reach out to us at 678-905-4450 or by visiting our website at www.wiserinvstor.com.

Have more questions? Contact Us

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.