Will Coronavirus Affect Social Security?

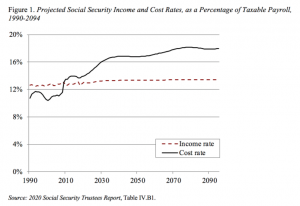

Over the last few years, Americans entering retirement have feared reductions in Social Security benefits and those new to the workforce have feared the dissolution of it altogether. And the coronavirus has only amplified these fears. The United States has been in jeopardy of depleting the Old-Age and Survivors Insurance (OASI) Trust Fund for quite a while. It is anticipated the fund will become insolvent by 2035. After that point, income and payroll taxes would only cover 75% of the benefits. There are many reasons for the decline and some have to do with longer life expectancy than previous generations.

Due to the aging population of the baby boomer generation, the Trust will be distributing more in the form of income than it will be receiving from revenues. Unfortunately, coronavirus has also helped intensify this issue, and some believe the benefits could be depleted by this decade because of the record levels of unemployment. However, Congress would be able to hold off the decline by reducing benefits, increasing revenues, or raising beneficiary ages.

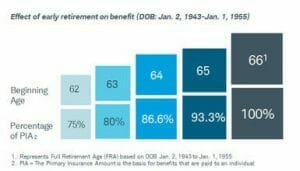

Social Security payment calculations are very detailed and difficult to understand. Luckily there are various tools and calculators available, and ssa.gov even lays out taxpayers anticipated benefits based on social security numbers. In order to first start the manual calculation, one must realize it is based off of your highest 35-year earnings. If you did not work for 35 years, you would use 0 for those non-working years and average them all out. The amount is then adjusted for inflation and called your Average Indexed Monthly Earnings (AIME). This is used as your base and then helps determine your Primary Insurance Amount (PIA). For 2020 your PIA is 90% of the first $960 of AIME, plus 32% over $960 through $5,785 AIME, plus 15% over $5,785. This final number, or PIA, is the amount of insurance you could receive if you filed early once eligible at age 62.

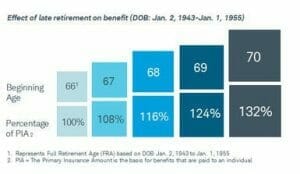

However, the benefits are increased by 6.7 % a year until you reach your Full Retirement Age (FRA). FRA depends on the year in which you were born. If you were born between 1943-1954 it is 66, and it is 67 if you were born after 1960. Also, if you waited past full retirement age, benefits would begin to increase an additional 8% a year as shown below. The maximum amount one individual could receive today on max 35-year earnings claiming at age 70 would be $3,790 monthly.

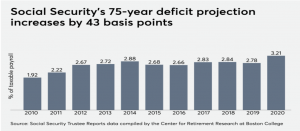

The issue now is whether these amounts will increase annually with inflation and include Cost of Living Adjustments (COLA) or stay the same. COLA is meant to help keep pace with inflation as money in today’s dollars is not the same as in twenty years. Just look at the cost of milk or gas. While the COLA for 2021 most likely will be 0% for the fourth time in last decade, there will eventually need to be some changes. According to Alicia Munnell, the director of the Center for Retirement Research at Boston College “falling wages can have significant implications for the Social Security benefits of currently nearing retirement.”

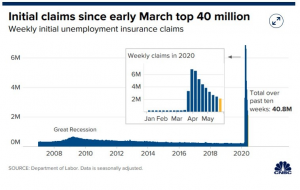

Due to COVID-19 there will be some material changes to the system. Lower payroll tax revenue, and acceleration of benefits will cause a reduction in the interest on the already depleting funds. According to data from Center for Retirement Research at Boston College, the program could still be fully solvent through 2094 with payroll tax increases of 3.1 percentage points in 2020, or 4.1 when it’s projected to become insolvent in 2035. The shutdown of the economy caused by this pandemic has caused record levels of unemployment. Since March the number has skyrocketed to over 40 million. Unemployment is over 14% currently and could go to over 20%. This will be a long process and could still be near double digits next year. These tens of millions of individuals are not paying into the system with payroll taxes.

Another factor is forced retirements and older workers deciding not to return to the workforce when the pandemic is over. This could also cause them to rely on Social Security more than anticipated. These people are not paying into the Social Security system while not working. Usually the employer and employee are taxed equally on the 12.4% up to $137,700.

This is something that needs to be addressed and Congress has shown with recent events that they can be swift in their actions when needed. If they start to enact some legislation, we will be able to have this much needed source of income for generations to come. At Wiser Wealth Management we focus on financial planning with social security optimization being a cornerstone to planning and increasing cash flow for the effectiveness of financial plans. Should you have any questions, please reach out to us at wiserinvestor.com or by calling 678-905-4450.

Matthews Barnett, CFP®,ChFC®, CLU®, Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.