Differences Between: Money Market Accounts, CDs, and High Yield Savings

A frequent question we get asked at Wiser Wealth Management is, “what is the difference between a money market account, high yield savings account and a CD, and what are their returns?” Although they have similarities, there are some key differences to consider.

Savings and Money Market Accounts

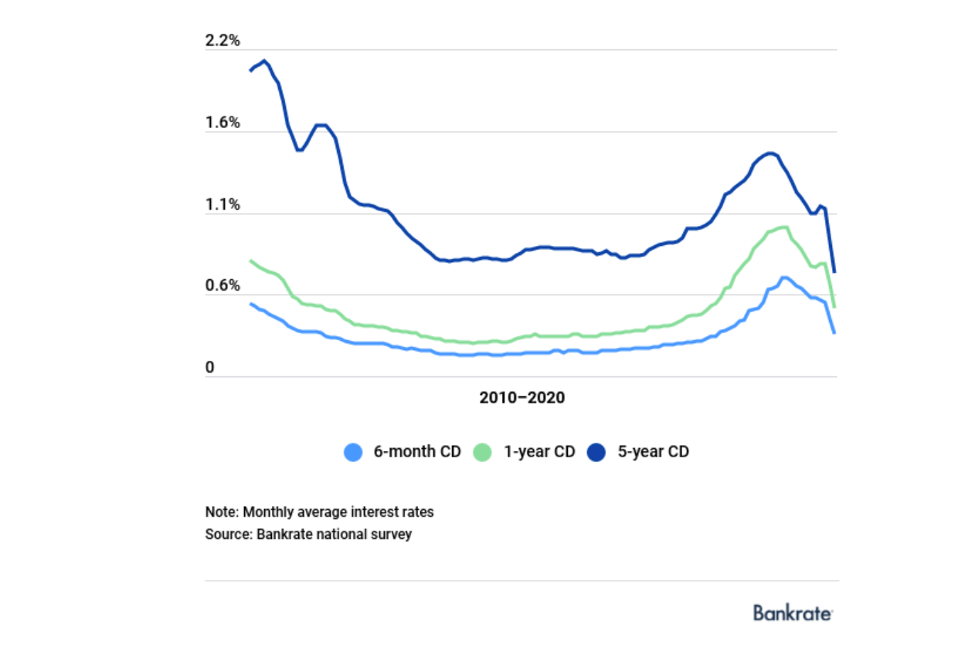

In the past, you could yield a nice return and outpace inflation by holding cash. About two years ago, we were seeing savings and money market accounts yielding close to 3%. Unfortunately, that is not the case in the current economic environment. Despite some notable online high yield savings accounts like Marcus by Goldman Sachs, Ally Bank, Discover, American Express and Citi that receive 0.5% Annual Percentage Yield (APY); most big banks, as of January 2021 according to FDIC, average APYs of only .05% for balances less than $100,000. How did this happen? Due to the economic effect of Covid-19, the Federal Reserve went from discussing interest rate increases to significant cuts. This has been good for liability accounts, but not so good for those wanting a significant long-term yield on their savings. Such low of APYs mean cash accounts alone cannot help you save for retirement and financial freedom.

How much should you have in savings?

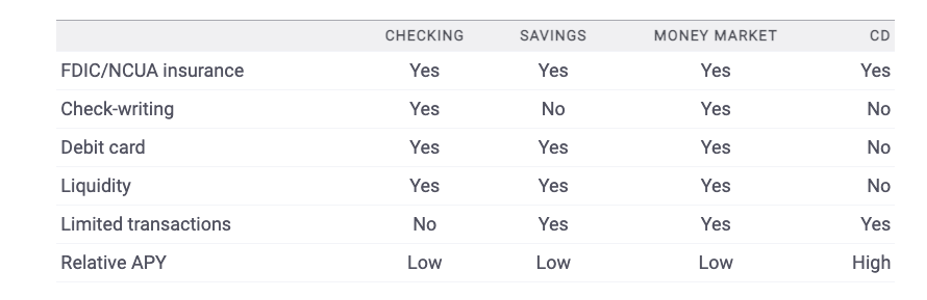

Cash savings accounts should really be for holding 3-6 months of expenses in case of emergencies, rather than building the bulk of your retirement. However, the upside to a short-term instrument such as these are investing in ultra-short bonds because those still get FDIC or Federal Deposit Insurance Corporation protection up to $250,000. This is where a money market account can come into play. A money market instrument is usually held for less than year and is a deposit account bearing instrument found at credit unions or banks. In the past, they usually had higher yields than savings and were used by people with larger amounts of cash. However, in the current economic environment, their yields are similar to savings accounts. Today, the main difference between them are the withdrawal allowances with savings usually being more limited. Therefore, if you have a bigger balance and will likely need to access those funds, a money market account could work for you.

Certificate of Deposit (CD)

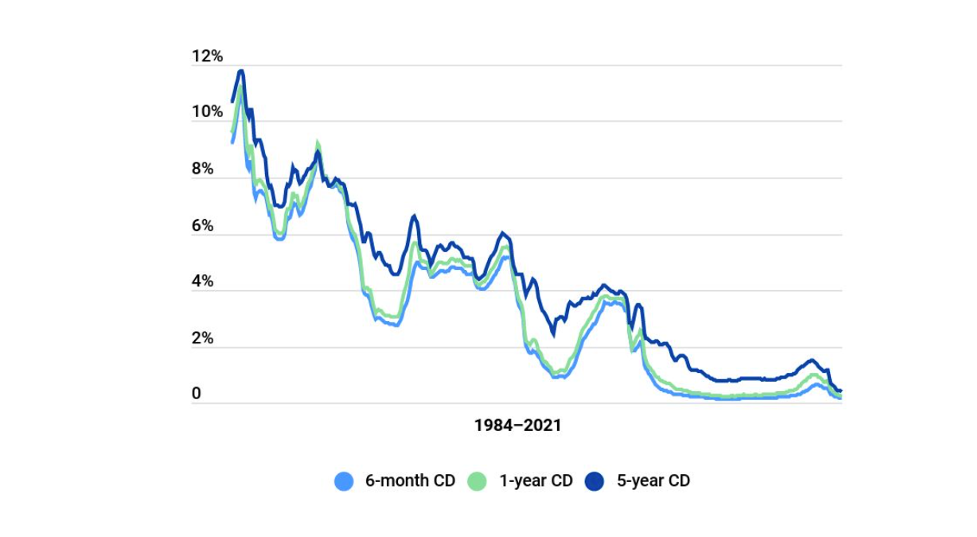

CDs are the ones that differ the most. While there are various CDs offered now (6-months, 12-months, 18-months, 24-months, or even 36-months), they are less liquid than money market and savings accounts as they usually do not allow withdrawals until a particular maturity date. For example, if you buy a 24-month CD, you will pay a fee if you withdraw any funds before the timeline expires. Usually, the longer the bank holds the funds, the higher the rates they offer. You are paid interest during the period and then the full principal at the end.

High Yield Savings Accounts

The world has changed with relation to cash and yields for retirement. As we’ve mentioned in previous blog posts, the long-term pillars of reaching financial freedom include paying off debt, having emergency savings for 3-6 months of expenses, and investing retirement funds in a diversified portfolio of long-term healthy asset classes. For short-term goals, there is not a huge difference in yield between savings accounts, money market accounts and CDs. However, keep in mind the key differences between them and how they fit your needs. Higher yield savings accounts come usually through online accounts that differ from your regular bank, which you might not feel comfortable with. If you are working with a bigger balance, a money market account might make sense over one of these high yield savings account. Also, if you foresee needing the funds in the near future, a CD might not make sense as it is less liquid. It is important to remember that each of these are options for short term needs only. They do keep up with inflation with little risk because of FDIC protections, but their limited long term yields do not make them the best options for growing retirement funds.

Have more questions? Contact us

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.