Keys to a Good Investment Strategy Foundation

Frequently, individual investors choose mutual funds based on the historical performance of the fund. Too many individual investors think it seems logical that past great performance will indicate a tendency for future great performance. According to a June 2021 report from S&P, this may not be the case, so here are keys to a good investment strategy.

Twice a year S&P Dow Jones Indices releases its Persistence Score Card. This reports tracks the consistency of top mutual fund performers over yearly consecutive periods asking the question, does past performance really matter?

The latest report shows that picking a fund purely based on performance is statistically a losing game as very few funds can consistently stay on top. Out of the funds that were top performers as of June 2021, only 4.80% managed to stay on top over three consecutive 24-month periods. Looking longer term, only 3.08% of large cap, 0% mid cap and 2.94% of small cap funds were able to stay in the top half of their peers over five consecutive years.

So what is an investor to do? When picking a mutual fund, you are really picking a fund manager. This fund manager is usually actively trading your money to beat his or her assigned index. They will have good years and bad years but statistically they will not beat their assigned benchmark over the long-term. I recommend that investors look at investing differently.

Keys to a Good Investment Strategy Foundation

- Keep your investment cost low – stay away from commission-based mutual funds and those advisors that sell them. Focus more on index mutual funds and/or Exchange Traded Funds (ETFs) that many independent advisors use, or if you are a do-it-yourself kind, consider using Vanguard funds. Make sure that you also understand how and what you are paying your advisor. Fee structures and the amount that you pay an advisor can vary greatly. All fees lower your return. You will have to decide what is fair for your situation.

- Ignore the short-term focused news cycles. If you are investing long-term, remember that the financial news media is focusing on today or tomorrow. You should not be worried about the next 2 years, if you have a 20-year time horizon. Build a portfolio that focuses on long-term healthy asset classes.

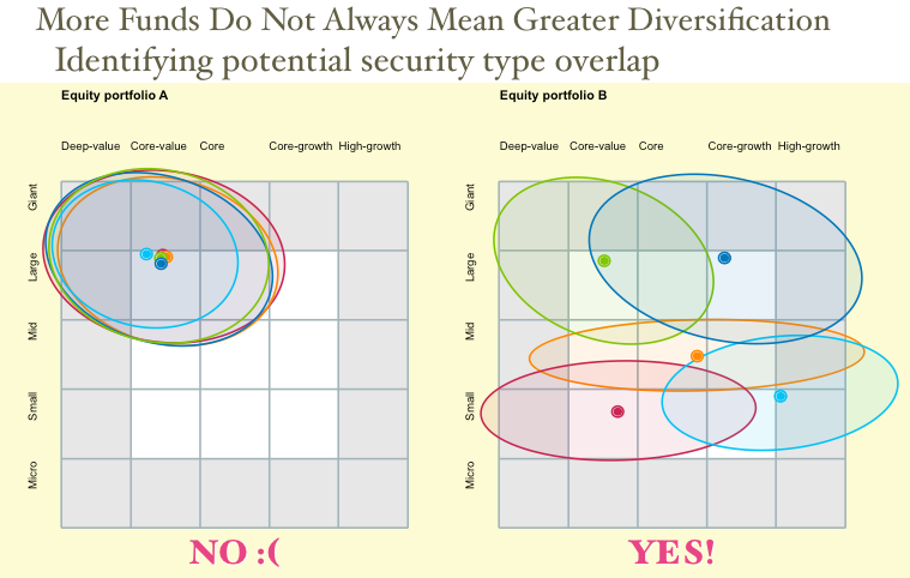

- When building a portfolio make sure the portfolio is diversified. Very often we see individuals hold three different large cap mutual funds. They think they are diversified but really they basically hold the same stocks in three different mutual funds. You want to create a mix of bonds, large company, medium company, small company and international stock. How you allocate to these categories will depend on your age and/or your tolerance for volatility within your portfolio.

- The most important aspect in investing is your financial behavior. Don’t try to time the market or make decisions based on how you feel. Focus instead on the long-term success of investing over any time period. For those still saving by adding money to your portfolio each month, you get the advantage of dollar cost averaging. This allows you to buy in the low times, making that money work harder for you over your lifetime.

You can view the S&P report here.

Have more questions? Contact us

President

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.