Medicare Considerations During Open Enrollment

Since Medicare open enrollment started back on Oct 15th, now would be a good time to discuss Medicare considerations. Healthcare expenses are increasing at an alarming rate of over 5%, well above the historic 2% annual inflation rate. Therefore, healthcare planning in retirement is an important aspect of an overall successful financial plan in relation to cash flow and coverages.

When to sign up

Retirees sign up for Medicare during a 7-month window at age 65: the 3 months before turning 65, the month you turn 65 or the 3 months after. This is when many retirees need to first elect coverage. Most do not pay a Part A premium and are automatically enrolled because they paid Medicare taxes while working. However, retirees need to apply for Medicare Part B. If you are late signing up for Part B after eligibility, then you must pay a late enrollment penalty premium in perpetuity.

Medicare Part A (Hospital Insurance)

- Inpatient care in hospital

- Skilled nursing facility care

- Hospice care

Medicare Part B (Medical Insurance)

- Services from doctors and other providers

- Outpatient care

- Medical equipment

- Preventative service

Medigap or Medicare Advantage (Part C)

- Helps pay for cost not covered by original Medicare

Medicare Part D (Prescription Drug Coverage)

- Helps pay for Prescription Drugs

As shown below, once enrolled in A and B, the next decision is whether or not to purchase a Medicare Supplement Insurance (Medigap) policy which is sold by private companies to help pay some of the health care costs that Medicare (A&B) doesn’t cover such as coinsurance, copayments or deductibles. Medigap policies don’t cover your share of the costs under other types of health coverage, including Medicare Advantage Plans (like HMOs or PPOs), standalone Medicare Prescription Drug Plans, employer/union group health coverage, Medicaid or TRICARE. If you choose Medigap policy, then you also need to look at Medicare Part D coverage for prescriptions. There are various coverages within the Part D plan as well so you will need to speak with a consultant or look at Medicare.gov website to see if current prescriptions are covered.

If you would prefer an all in one plan then you can choose Medicare Advantage or Part C. This option is an “all in one” policy that covers A, B, C and D and can be more basic or include all the bells and whistles. Even with the extra coverages, it usually has lower out of pocket costs than Medicare but could have higher premiums and requires stricter rules within network plans if you prefer keeping your current doctor or if have preexisting conditions. However, it does offer benefits not covered under Medicare like vision, hearing, dental and foot care.

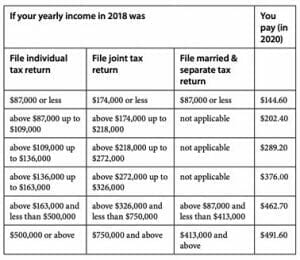

The Medicare Part B premiums are based on the income from the two previous tax years and can be anywhere from $144.60 to almost $500.

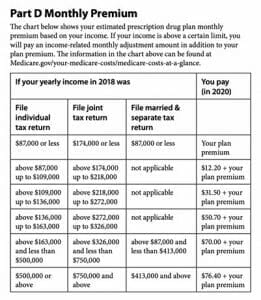

Part D coverage is also separate if under regular Medicare Part D program and like Part B premiums, it ranges based on income. They are priced based on plan premiums plus additional fees.

Notable for 2021, the Medicare Part A deductible increased by $76 from $1,408, in 2020, to $1,484. Medicare Part B premiums will increase $3.90 a month and will now reduce Social Security benefits by $148.50. This is significantly less than the 2020 increase of $9.10, but still important due to fact that Social Security Cost of Living Adjustment or COLA was only raised by 1.3% for this next year according to a recent announcement.

It’s important to look for open enrollment information in the mail or by searching Medicare’s website to educate yourself on the changes and how certain policy and coverages might change such as monthly premiums, out of pockets costs, deductibles, coinsurance, network providers, and drug coverages. During this open enrollment period, which ends December 7th, retirees can change part D, or their Medicare Advantage plan. If you need to do due diligence and check that physicians and prescriptions are still covered or if you need to make some adjustments so that you can keep doctors, now is the time.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.