Robinhood Continues to Make Headlines

If you have been watching any financial news media outlets during the pandemic, you may have seen the millennial trading application called Robinhood surge in popularity. According to Robinhood’s website, the company began “at Stanford, where founders Baiju and Vlad met as roommates and classmates. After graduation, they packed their bags for New York and built two finance companies, selling trading software to hedge funds. With their newfound experience in the world of finance, they realized that big Wall Street firms pay effectively nothing to trade stocks, while most Americans were charged commission for every trade. They soon decided it was more important to build products that would provide everyone with access to the financial markets, not just the wealthy. Two years after heading to New York, they moved back to California and built Robinhood—a company that leverages technology to encourage everyone to participate in our financial system.” Robinhood has become a gamified way to invest and has attracted a younger generation of investors.

Although Robinhood was started just seven years ago, on Monday they announced their third round of investments in just over four months. The company is now valued at $11.2 billion dollars after the recent $200 million-dollar Series G funding round from venture capitalists, specifically D1 Capital Partners. Main investors include prominent names like Sequoia, Kleiner Perkins and Google’s venture arm, GV. Before the new funding, the company was valued at $8.6 billion.

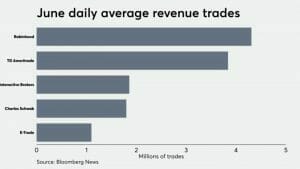

Robinhood had 4.3 million daily average revenue trades (DART) in June. That is four times higher than E-Trade and even higher than publicly traded companies during this period. Although Robinhood made the news for the wrong reason in March (when the company app shut down multiple times during pullbacks in the market and clients were not able to sell or buy the dips), it does not seem to have been a major setback for the firm. Robinhood now has a higher value than some S&P 500 companies.

(Source: Financial-Panning.com)

The firm has also received more than 3 million new users in 2020, about half of which are first timers, and the company moved past 13 million accounts as of May. The success of Robinhood is tied in to how easy it is to use and how it has paved the way for free trades and stopped transaction fees. The firm makes money by selling the transactions to larger Wall Street firms.

My blog back in May about the JETS ETF and Robinhood investors’ behavior, and even though the fund was down almost 60% YTD, investors took a contrarian view on the fund. According to Robinhood, in February only 250 accounts held the JETS fund while in May; after quarantine, over 20,000 investors did. The price of the fund was going down while the number of investors increased. Investors were not looking at the falling price of the stocks. These investors were betting on the intrinsic value of the companies. Investors believed airlines would otherwise be thriving if it were not for the coronavirus pandemic. Investors were investing in falling airlines, cruise lines and even bankrupt companies like Hertz. According to Robintrack.net, which keeps track of what investments Robinhood users hold, these were the most popular companies over the last 30 days.

(Source: Robintrack.net)

You may recognize a lot of these companies as they are household names. While at the start of the pandemic, it was value plays like Delta, American and Carnival and now investors are flocking to growth firms like video gaming, biotech and big tech names like Microsoft, Facebook, Apple, Amazon, Netflix and Google.

The S&P just hit an all-time high as of Tuesday, August 19th. It was the first new high in the market since February and it was a huge 54% turnaround since the March 23rd lows of -34%. Those household technology names have led this charge out of recession. It has been said to invest in names you know, and millennial investors know these names more than anyone.

In the past, younger generations were criticized for not investing and there were talks of the disparity in market involvement between generations. However, with the advent of no commission and transaction free trading on apps, along with stock slice investing, younger and less affluent investors can buy fractional shares of big-name companies they know and care about.

It is good that people are becoming involved with the market, but it is important to still conduct due diligence and make informed decisions. While trading individual stocks may be fun and provide great opportunity for growth, it also carries a risk premium and investors should be careful. At Wiser Wealth Management, we do not advocate individual speculative investing, but believe clients should invest in long-term healthy asset classes through a portfolio of low-cost ETFs. Investors need to be careful that they are not trying to chase winners or the next Tesla or Amazon, but focus on diversified portfolios to reach their financial goals.

Matthews Barnett, CFP®, ChFC®, CLU® Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.