Will there be a recession in the next year?

If you’ve watched or listened to the news recently, you may believe a recession is inevitable in the next 12 months. Between the escalating trade war with China and slowing global growth, rumors of a recession are everywhere. Although the recent 2 year/10 year yield curve inversions have spooked the markets, Vanguard doesn’t expect a recession in the next 12 months.

According to Vanguard’s recent market prospective, all signs point to central banks lowering interest rates again in 2019, with the magnitude dependent on the shape of the yield curve. As seen over the years, interest rate changes have been an indicator of the state of the market. Thus, Vanguard puts the chance of a recession over the next 12 months at 40%.

Looking internationally, softening global growth is expected to continue over the next year which is driven by a slowdown in growth with Chinese economies and the high tension of the US-China trade war. In the euro area, Vanguard has lowered their forecasts slightly as manufacturing activity continues to contract.

Despite some signs pointing to a recession, Vanguard is optimistic that a recession will not occur in the next year. Although international news seems to be unfavorable, the US consumer is still holding strong with key market stability indicators including low unemployment rates, low inflation, lowering interest rates and good savings rates. These factors all contribute and continue to fuel our robust economy.

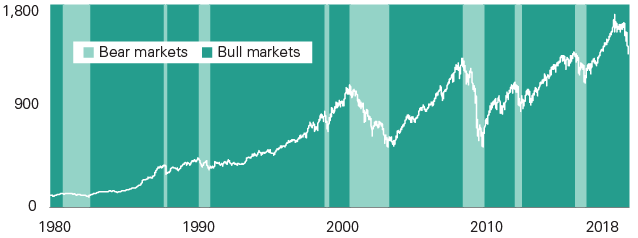

Even though downturns are typically associated with negativity, they are not rare market events since fluctuations have always been a sign of a healthy market. In fact, the typical investor will endure many market downturns in their lifetime. There has been at least one attention grabbing downturn every TWO years since 1980. Our advice if a recession happens, or with any market change, is to stay the course and avoid short-term market jitters.

One attention-grabbing downturn every two years:

12 corrections

Decline of 10% or more

8 bear markets

Decline of 20% or more, at least 2 months long

Source: Vanguard analysis based on the MSCI World Index from January 1, 1980, through December 31, 1987, and the MSCI AC World Index thereafter. Both indexes are denominated in U.S. dollars.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.