Tax Strategies for High Income Earners

Earning a high income is a good problem to have. One element of that good problem is a higher tax bill. However, there are some tax planning strategies to help reduce taxes.

Tax Loss Harvesting

One of simplest methods we use at Wiser Wealth Management is tax loss harvesting within our asset management. This can be done throughout the year and the process provides value by selling a security or a fund, at a loss and “harvesting” it to offset potential gains. The investor can then repurchase one that is similar, but not substantially identical in order to avoid the “wash sale” rule and maintain preferential tax treatment. Keep in mind, though, the importance of avoiding a violation of the “wash sale” rule. It is an IRS rule preventing investors from taking the aforementioned loss deductions. It applies when someone sells a certain security at a loss and then within 30 days or less, purchases another similar or substantially identical security. Also, the rule applies if a spouse does the same thing during that time period.

If tax harvesting is done properly, however, once the investor offsets the capital gains due to the losses, he/she can even use up to $3,000 annually against ordinary income with the extra losses carried over into future years indefinitely. It is important to note that in this strategy, we are not getting out of the market or changing our allocations. Rather, we take some losses and then reinvest back into similar funds for at least 30 days.

In the example below from Charles Schwab, an investor in the 35% combined federal/state tax bracket might take advantage of a $25,000 loss of a security or fund on an account with a $20,000 capital gain. They could apply $20,000 at their tax rate for $7,000 in potential taxes on the capital gains and then use $3,000 against ordinary income for the potential $8,050 in savings. The remaining money could then be applied to offset future gains.

Donor Advised Funds

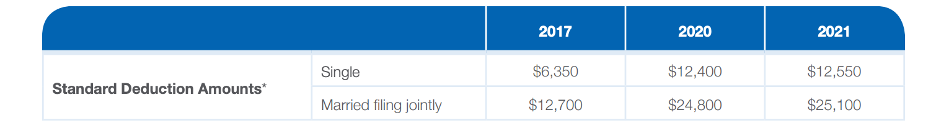

When the tax code changed in 2017 and the standard deduction was almost doubled, many households began taking the standard deduction rather than itemizing their deductions. The Tax Cuts and Jobs Act (TCJA) signed into law December 2017 and implemented in 2018 is currently set to sunset after 2025. As shown below, deductions nearly doubled. In 2021, single filers can claim up to $12,550 or married couples filing jointly can claim a whopping $25,100.

If you are a high-income earner or have received an anticipated windfall, you may need additional deductions and there are various strategies for going about this that you should discuss with your financial planner and CPA. One such strategy is to set up a Donor Advised Fund or DAF. These are offered through various brokerage firms or even through community foundations if you want to use some of your funds to give back to local community. Here in Marietta, the Cobb Community Foundation is one such fund.

A big bonus or the sale of a business can create a much larger tax liability than one would desire. This is where the heart and the pocketbook can work together to lower your tax liability. Charitable donations normally lower your tax liability at the rate of your highest taxed dollar. You might be looking at giving $20,000 or $100,000 or perhaps even more, but you may not know yet exactly which charities you want to support. But, again, you also don’t want to face a larger tax liability. One option is to form your own 501(c)(3), but this is a large task, especially last minute. This is where Donor Advised Funds or DAFs comes in handy. DAFs allow you to move cash, stocks or a non-publicly traded asset into an account and take a tax deduction in the same year. This also allows you to issue funds to IRS approved organizations in the future. Plus, the funds can grow tax free. This is a great way to build a legacy that can keep giving for generations to come. According to the National Philanthropic Trust, the number of DAFs rose over 16.2% in last year for a total of over $142 billion in assets.

When you make the donations, you are eligible for an immediate tax deduction. However, this does not mean you have to distribute the actual grants within that year. You are allowed to decide over the following years what you wish to do with the money. Also, there are different rules with certain donations. For cash donations, investors are eligible for an income tax deduction of up to 60% adjusted gross income or AGI. For appreciated securities, you would want to donate those directly to funds rather than liquidate them and pay the long-term capital gains rate taxes. It also allows for deductions of the full market value of security up to 30% of AGI.

DAFs are also simple to administer once they’ve been established. When you’re ready to support a charity of your choice, you can simply log in to your account and recommend a grant to any IRS-qualified public charity. Let’s say you are not sure if you should take the standard deduction or if you need additional itemized deductions with the charitable contribution listed. In the example shown below, the married couple in Option 1 has $23,000 of annual deductions including a $10,000 gift to charity. However, if it is below the $25,100, they could take the deduction each year and while the charitable donations went to a good cause, it did help in the reduction of their taxes. This is where strategy or Option 2 comes into play. This is where someone could look into the “bunching” of donations. This approach puts multiple years of donations bunched into one creating a bigger lump amount for the current year. For example, you could have two years of charitable donations of $10,000 each for $20,00o as well as other various deductions. This $33,000 in itemized deductions is over the standard deduction and can help save in additional taxes as well as plan accordingly for years when income might be higher than anticipated.

1031 Exchanges

If you own an investment property and are not a fan of paying additional taxes, the 1031 exchange could be a strategy for you. 1031 exchanges are named for Section 1031 of U.S. Internal Revenue Code that allows real estate investors to defer paying taxes from the sale of their investment property. It is important to realize this does not make the sale tax-free. It makes it a tax deferral and a 1031 exchange can be tricky to implement. There are a few caveats and moving parts when applying the 1031 exchange, so it is important to go through all the proper steps to avoid any future issues.

First, the proceeds from the sale of the property will need to be held by a qualified intermediary and not the individual person. There are many companies that specialize in 1031 exchange transactions. How then are the actual capital gains calculated? While your primary home will have either $250,000 (if single) or $500,000 (if married) exempt from capital gains taxes, this does not apply to investment properties. The amount taxable would be calculated on a net adjusted basis. This is the original price paid for the property plus improvements minus depreciation. Also, the new property must be a “like kind property.” This term is used broadly and does not necessarily mean similar properties.

After funds are in the intermediary, the future investment property or properties must be identified within 45 days of sale. Also, the new property transaction must be fully completed within day 180. If there is additional cash from the replacement, it is known as “boot” and this can be taxed as gains. This can also apply to new loans if the new loan is less than the original one, which can cause the new property to be valued as less.

Qualified Opportunity Zones

As previously mentioned, the passage of the new Tax Cuts and Jobs Act (TCJA) under the Trump administration in 2017 changed some key tax laws. Certain exchanges of property like licenses, aircraft, and equipment are no longer eligible for a 1031 and must now be only real property. However, having a property in mind and wanting to continue with investment management may not be the only scenario where these tax programs can apply. What also came about from the TCJA was the creation of what is known as “qualified opportunity zones.” The program was created to provide for the revitalization of certain areas through the reinvestment of capital gains into low-income neighborhoods. These investments build up those areas by incentivizing investments from investors for the deferral of previous capital gains. There are various companies that manage these funds and you would need to complete your due diligence to find one that fits your needs. The way they work is that the investor is able to defer recognizing the original gain until December 31, 2026, and receive at least a 10% reduction in gain from tax liability if held for at least 5 years, and up to 15% if held for 7 years. The investment also has tax-free appreciation in QOF if held for at least 10 years. There are many ways these gains can be invested through these various fund companies, as long as it is done within 180 days of the initial capital gains transaction.

Qualified Charitable Distributions (QCDs)

QCDs are also a good year-end way to minimize tax bills. This is a direct transfer of funds from an IRA to a qualified charity. These satisfy the required minimum distribution or RMD requirement, but it also allows the money to be excluded from taxable income. And it does not require an investor to itemize. In order to qualify, the investor must be at least 70 1/2 and the max that can be distributed is up to $100,000. The receiving charity must be a 501(c)(3) organization and contributions cannot be made to private foundations or transferred into a donor advised fund.

Charitable Remainder Trusts

The SECURE (Setting Every Community Up for Retirement Enhancement) Act of 2019 significantly changed many rules and regulations for retirement accounts like 401ks and IRAs. One such change now mandates that non-spousal IRA beneficiaries, such as children or relatives, must deplete any inherited accounts within 10 years. As we have discussed in previous blogs and podcasts, this has significant implications for retirement and estate planning.

Previously, you had the option to set up what was called a “stretch IRA.” This allowed for smaller Required Minimum Distributions (RMDs) to be withdrawn based on your beneficiary’s own life expectancy. In return, this meant less of the investment ended up as taxable income and more of it remained in the account to continue growing tax free. With the new law, the account does not require RMDs, but states that the account must be depleted by year 10. Exceptions to the new 10-year rule include the Eligible Designated Beneficiaries, or EDBs, who can still use the stretch method. This includes the spouse, minor children of the deceased IRA owner or plan participant, disabled, chronically ill, or beneficiaries who are not more than 10 years younger than the deceased IRA owner.

In light of these changes, an often-overlooked option has gained popularity among those with larger balances and/or those who are charitably inclined—namely, designating a Charitable Remainder Trust (CRT) as the IRA beneficiary. When a CRT is initially set up, two beneficiaries get listed, the person receiving the income for life and then the charity to receive the remainder after their passing.

This option can be drafted one of two ways, either the charitable remainder unitrust (CRUT) or the charitable remainder annuity trust (CRAT). Payment from a CRUT is based on a percentage of assets, of at least 5% valued annually, while a CRAT is setup for fixed payments. The use of a CRT allows more of the account to be distributed to a beneficiary over their lifetime while also providing significant amounts to charity. Keep in mind that the amount of the charity’s remainder interest must be at least 10% of the value of the trust at its inception so these are usually more suitable for beneficiaries who are more middle aged and higher income earners themselves.

As an example, let’s say a 50-year-old woman inherits an IRA with a balance of $400,000. Under the new SECURE Act, she will be required to withdraw that full balance within 10 years. She could withdraw one amount every year, every few years, or wait to take it all as lump sum in year 10. If she takes approximately 1/10 in year one, $40,000, and she is in the 22% tax bracket, she will pay around $8,800 in additional income tax for that year. And a similar scenario will play out each year moving forward, depending on the performance of the account, until its required depletion date in year 10.

This withdrawal strategy differs when a CRT is listed as the beneficiary of the $400,000 IRA. The CRT would receive the full value of the account and then the beneficiary would receive a fixed number of payments for the lesser of her lifetime or 20 years. The trust is invested so, hopefully, it grows an income of say $4,000 after expenses. In the first year, if the beneficiary listed in the CRT receives 7% of the total amount, or $28,000, then $4,000 is attributed as income earned by the trust. Of that distribution, the beneficiary will pay only $880 in additional income tax ($4,000 x 22%). The tax savings is even more dramatic if the beneficiary is in a higher tax bracket.

There are some downsides to using a CRT over the typical individual beneficiary designation. First, you must pay an estate attorney to initially draw up the trusts and this can be costly. Second, you would need to have a CPA help you with the amount of income distributed, and the annual maintenance and filing fees. Additionally, if the initial beneficiary passes away soon after inheriting, the full amount goes to the listed charity and cannot be passed on to any other family members. However, setting up a CRT can be beneficial if you have a large IRA balance, you have children who are middle aged and high-income earners, and you are charitably inclined. Given the changing rules and regulations for inheritance and retirement, a CRT is certainly worth discussing with a team of financial advisors, CPAs, and Tax Attorneys.

Tax Strategies Overview

While each of these may not be suitable for all investors, these are some ways to reduce taxes for high-income earners. It is important to work with a team of advisors including not just a Financial Advisor, but also a CPA and even an attorney in some cases. Given the complexities within the tax code, especially for those in the higher brackets, proactively planning throughout the year can be a tremendous help.

Click here to schedule a consultation with one of our financial planners.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Listen to Our Podcast:

Download our free guide: “Your Pre-Retirement Checklist”

Have more questions? Contact Us

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.